Some Known Details About Pvm Accounting

Wiki Article

See This Report about Pvm Accounting

Table of Contents10 Easy Facts About Pvm Accounting ShownThe Basic Principles Of Pvm Accounting Some Of Pvm Accounting9 Simple Techniques For Pvm AccountingPvm Accounting for DummiesWhat Does Pvm Accounting Do?

Make certain that the audit process complies with the regulation. Apply called for building accountancy requirements and procedures to the recording and reporting of building and construction activity.Connect with different funding agencies (i.e. Title Business, Escrow Firm) relating to the pay application procedure and needs required for payment. Help with carrying out and maintaining internal monetary controls and treatments.

The above statements are planned to describe the general nature and level of work being carried out by individuals assigned to this classification. They are not to be interpreted as an extensive list of responsibilities, duties, and abilities called for. Workers might be called for to do responsibilities beyond their typical obligations once in a while, as required.

Examine This Report on Pvm Accounting

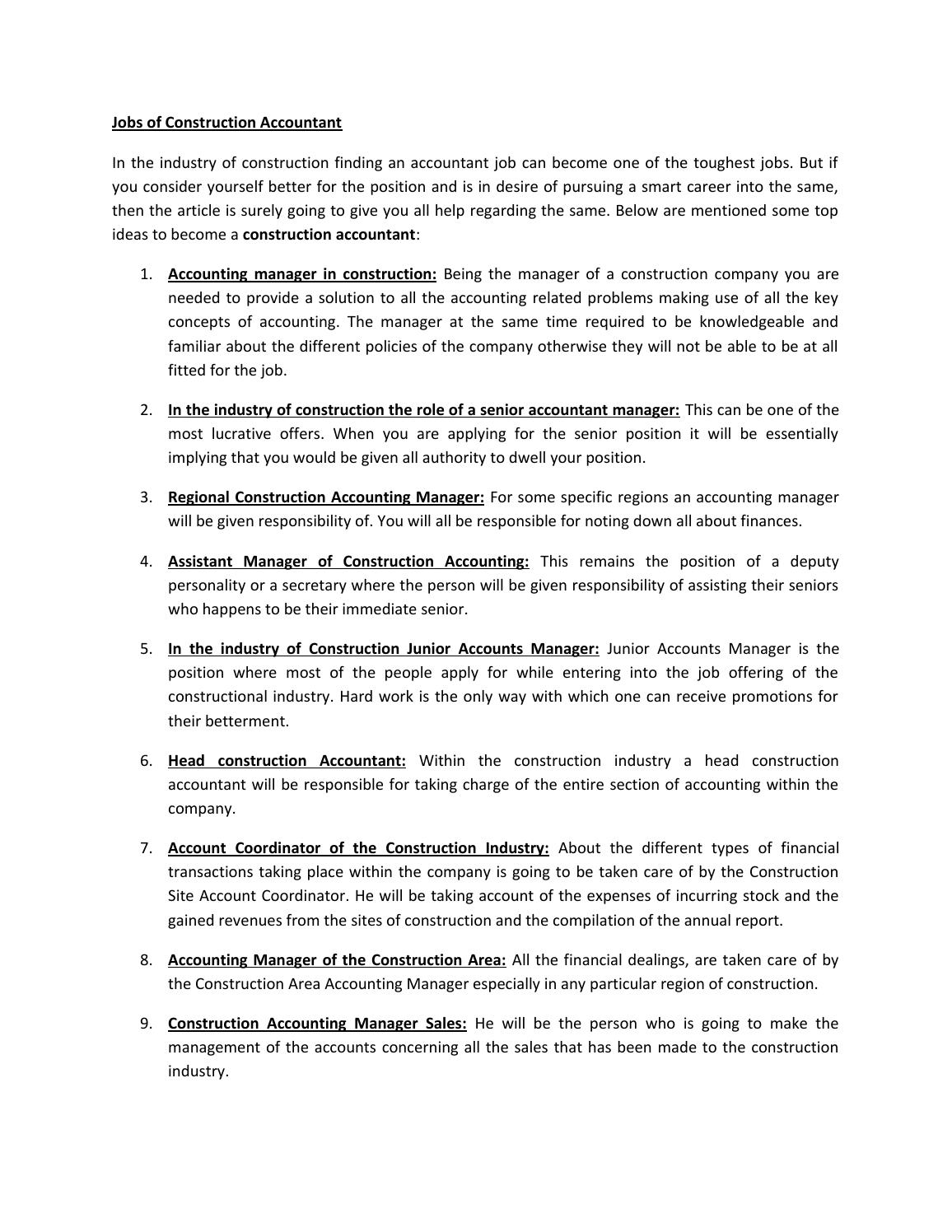

You will certainly help support the Accel team to make certain delivery of effective in a timely manner, on budget plan, jobs. Accel is seeking a Building Accountant for the Chicago Workplace. The Building and construction Accounting professional performs a selection of accounting, insurance conformity, and job management. Works both separately and within certain divisions to keep financial records and make certain that all records are maintained existing.Principal obligations consist of, yet are not limited to, managing all accounting features of the business in a timely and exact manner and offering reports and routines to the company's CPA Firm in the preparation of all financial statements. Makes certain that all accounting procedures and features are taken care of accurately. Liable for all financial records, payroll, banking and daily procedure of the audit feature.

Works with Job Managers to prepare and post all month-to-month invoices. Produces monthly Task Cost to Date records and working with PMs to fix up with Project Supervisors' spending plans for each task.

Unknown Facts About Pvm Accounting

Efficiency in Sage 300 Building and Property (previously Sage Timberline Office) and Procore building management software program a plus. http://go.bubbl.us/e25719/c0fc?/New-Mind-Map. Need to also be competent in other computer software program systems for the preparation of records, spread sheets and various other audit analysis that may be called for by management. construction taxes. Need to have solid business abilities and capacity to prioritizeThey are the financial custodians that make certain that construction tasks continue to be on budget, adhere to tax regulations, and keep financial transparency. Construction accountants are not simply number crunchers; they are calculated partners in the construction procedure. Their main role is to manage the financial aspects of building projects, making sure that resources are alloted efficiently and economic threats are minimized.

The Only Guide to Pvm Accounting

They work very closely with job managers to create and monitor budget plans, track expenses, and projection monetary demands. By keeping a tight grip on project financial resources, accounting professionals aid avoid overspending and economic troubles. Budgeting is a cornerstone of effective construction projects, and building accounting professionals are instrumental hereof. They develop in-depth budgets that include all job expenses, from products and labor to authorizations and insurance.Construction accountants are skilled in these regulations and ensure that the job abides with all tax obligation demands. To excel in the role of a construction accountant, individuals require a solid educational structure in accountancy and financing.

In addition, certifications such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry sites Financial Professional (CCIFP) are highly pertained to in the market. Functioning as an accounting professional in the construction industry includes an unique collection of difficulties. Building and construction projects frequently involve limited deadlines, altering regulations, and unanticipated expenditures. Accounting professionals should adapt rapidly to these challenges to maintain the task's financial health and wellness undamaged.

Everything about Pvm Accounting

Professional qualifications like certified public accountant or CCIFP are additionally very recommended to demonstrate expertise in building bookkeeping. Ans: Building and construction accounting professionals create and keep an eye on budget plans, determining cost-saving opportunities and making sure that the project stays within budget plan. They likewise track expenses and projection economic needs to stop overspending. Ans: Yes, building and construction accounting professionals take care of tax compliance for construction jobs.

Introduction to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business have to make challenging choices amongst lots of monetary options, like bidding process on one project over one more, selecting financing for materials or devices, or establishing a job's earnings margin. Building is an infamously unstable industry with a high failure price, sluggish time to repayment, and inconsistent cash money circulation.

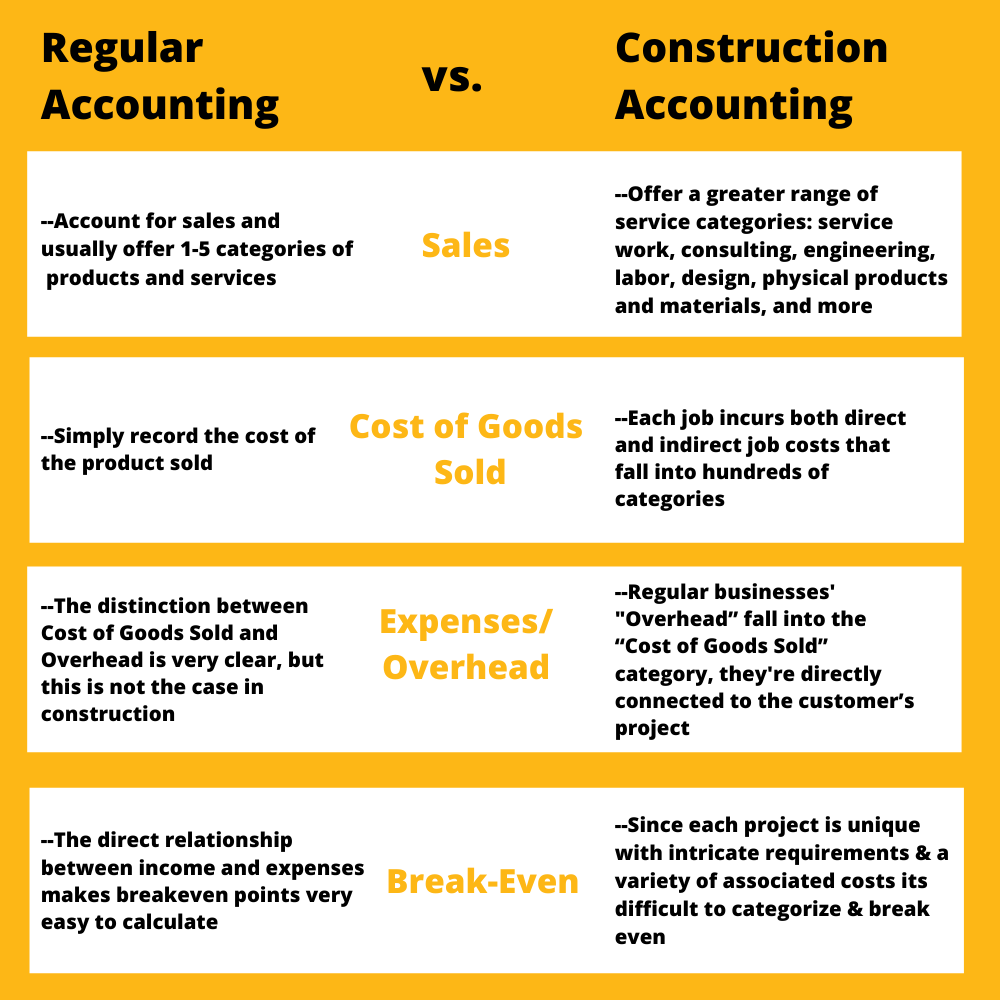

Normal manufacturerConstruction business Process-based. Production entails duplicated procedures with easily identifiable prices. Project-based. Manufacturing needs different procedures, materials, and devices with differing expenses. Fixed place. Production or manufacturing takes place in a solitary (or a number of) controlled areas. Decentralized. Each project occurs in a brand-new place with varying site problems and special challenges.

Not known Factual Statements About Pvm Accounting

Regular usage of various specialized professionals and suppliers impacts effectiveness and money flow. Settlement gets here in full or with normal payments for the full contract quantity. Some part of settlement may be withheld up until project completion even when the service provider's job is ended up.Normal production and short-term contracts cause workable money circulation cycles. Uneven. Retainage, slow-moving settlements, and high ahead of time costs lead to long, uneven cash circulation cycles - financial reports. While conventional suppliers have the benefit of regulated atmospheres and optimized manufacturing procedures, construction companies must continuously adjust to each new project. Also somewhat repeatable jobs require alterations as a result of website conditions and other elements.

Report this wiki page