Unknown Facts About Transaction Advisory Services

Wiki Article

The Transaction Advisory Services Statements

Table of ContentsThe smart Trick of Transaction Advisory Services That Nobody is DiscussingGetting The Transaction Advisory Services To WorkThe Facts About Transaction Advisory Services UncoveredThe Basic Principles Of Transaction Advisory Services Everything about Transaction Advisory Services

This step ensures the company looks its ideal to prospective purchasers. Getting business's worth right is important for an effective sale. Advisors utilize various methods, like affordable money flow (DCF) evaluation, comparing with comparable business, and recent purchases, to figure out the fair market value. This helps set a reasonable price and negotiate efficiently with future purchasers.Deal experts step in to aid by getting all the needed information arranged, addressing inquiries from customers, and organizing check outs to the organization's location. Purchase experts utilize their proficiency to assist service owners take care of hard negotiations, meet buyer expectations, and structure offers that match the owner's goals.

Fulfilling legal policies is crucial in any type of business sale. They help organization proprietors in planning for their next steps, whether it's retirement, beginning a brand-new venture, or handling their newly found wide range.

Purchase advisors bring a wide range of experience and understanding, ensuring that every facet of the sale is managed professionally. Through calculated preparation, assessment, and settlement, TAS aids entrepreneur accomplish the highest possible sale rate. By ensuring lawful and regulative conformity and managing due persistance alongside other offer group members, deal advisors minimize possible dangers and obligations.

Examine This Report on Transaction Advisory Services

By contrast, Large 4 TS groups: Work with (e.g., when a potential buyer is performing due persistance, or when an offer is shutting and the buyer needs to integrate the firm and re-value the seller's Annual report). Are with charges that are not linked to the bargain shutting successfully. Gain costs per engagement someplace in the, which is much less than what financial investment banks earn also on "little bargains" (yet the collection possibility is likewise a lot greater).

The interview concerns are really similar to financial investment banking meeting questions, but they'll concentrate a lot more on accounting and appraisal and less on subjects like LBO modeling. Anticipate inquiries about what the Change in Working Resources means, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like trial equilibriums and exactly how to go through occasions utilizing debits and credit scores rather than financial statement changes.

Examine This Report on Transaction Advisory Services

that demonstrate how both metrics have transformed based upon products, networks, and customers. to judge the accuracy of management's past forecasts., consisting of aging, stock by item, average degrees, and provisions. to establish whether this content they're entirely fictional or rather credible. Experts in the TS/ FDD teams may likewise interview management regarding whatever over, and they'll create a thorough report with their searchings for at the end of the process.The pecking order in Transaction Services differs a little bit from the ones in investment banking and exclusive equity professions, and the basic shape resembles this: The entry-level function, where you do a whole lot of data and financial analysis (2 years for a promotion from here). The next degree up; comparable work, yet you get the more interesting bits (3 years for a promotion).

In particular, it's challenging to get advertised past the Supervisor degree due to the fact that couple of individuals leave the job at that stage, and you need to begin revealing evidence of your capability to generate income to advancement. Allow's begin with the hours and way of living since those are easier to describe:. There are occasional late evenings and weekend job, but absolutely nothing like the agitated nature of financial investment banking.

There are cost-of-living modifications, so anticipate lower settlement if you're in a more affordable location outside significant financial (Transaction Advisory Services). For all placements except Partner, the base pay consists of the mass of the total compensation; the year-end bonus could be a max of 30% of your base salary. Frequently, the finest way to increase your profits is to switch over to a various company and work out for a greater income and bonus offer

The Single Strategy To Use For Transaction Advisory Services

At this stage, check my reference you need to just stay and make a run for a Partner-level function. If you want to leave, possibly relocate to a client and do their assessments and due persistance in-house.The major issue is that since: You generally need to join an additional Big 4 group, such as audit, and job there for a few years and afterwards move right into TS, work there for a few years and afterwards move into IB. And there's still no warranty of winning this IB function due to the fact that it depends upon your area, customers, and the working with market at the time.

Longer-term, there is likewise some risk of and due to the fact that reviewing a company's historical economic info is not exactly rocket scientific research. Yes, people will certainly constantly require to be entailed, but with more sophisticated technology, reduced head counts can possibly sustain customer interactions. That claimed, the Transaction Solutions team defeats audit in terms of pay, check out here job, and leave chances.

If you liked this write-up, you may be thinking about analysis.

Transaction Advisory Services Can Be Fun For Everyone

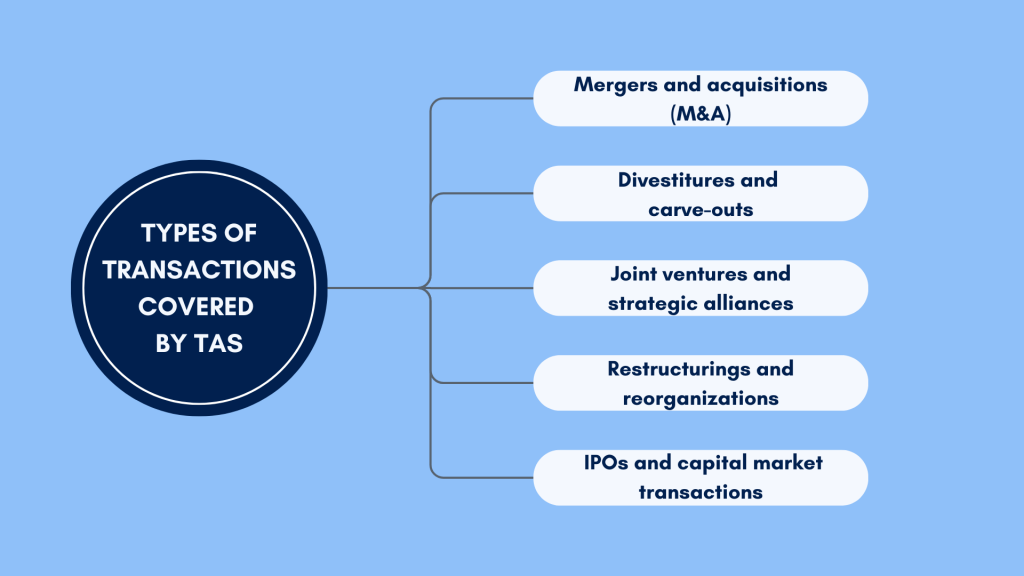

Establish innovative economic structures that assist in determining the real market price of a company. Supply advisory operate in connection to company evaluation to assist in bargaining and prices structures. Discuss the most ideal type of the bargain and the kind of consideration to employ (cash, supply, gain out, and others).

Create activity strategies for danger and exposure that have actually been recognized. Do integration preparation to figure out the process, system, and business changes that might be called for after the deal. Make mathematical price quotes of combination expenses and advantages to examine the financial reasoning of combination. Establish standards for incorporating departments, innovations, and company processes.

Determine possible reductions by decreasing DPO, DIO, and DSO. Assess the prospective consumer base, industry verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides essential understandings right into the functioning of the company to be acquired worrying danger evaluation and value production. Determine short-term modifications to finances, financial institutions, and systems.

Report this wiki page